Sustainable Finance Round Up: February 2023

By: Bridget Realmuto LaPerla

March 23, 2023 - 2 minutes 30 seconds

Our Monthly Round Up Series delivers clients with digestible trends and take-aways on sustainable debt market movement.

Market Musings

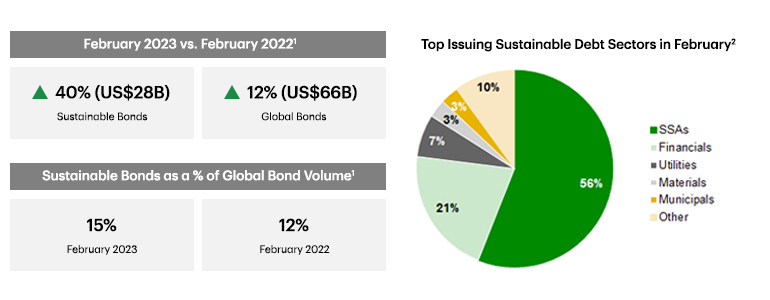

Global ESG issuance forged ahead in February with US$93bn of sustainable bond issuance, representing a 40% increase vs. February 2022. Notably in the sustainable bond market, YTD-23 issuance volumes were the largest on record, outpacing the previous high set in 2022 by 10%, led by the EUR market. With the heightened scrutiny on SLBs, green bonds have seized market share accounting for 55% of total bond and loan issuance this month compared with the recent historical average of ~40%, a trend we expect to see continue this year.

Greener Pastures in the EUR Market?

What Happened:

- EUR sustainable bond issuance has started the year on a tear – with €96bn pricing YTD (up 51% from prior year), Q1 2023 is on track to be one of the strongest quarters on record.

- While this trend is observed across all sectors, it is most noteworthy in the Corporate and FIG markets which have seen ESG supply increase by 51% and 76% YoY, respectively.

- The ECB corporate bond portfolio ESG tilt and flows to Article 8/9 funds are partly to thank but not the only factors – record inflows to EUR fixed income has lifted overall primary market supply and favourable execution dynamics have incentivized borrowers to come in ESG format.

- Whereas other markets have been impacted by anti-ESG headlines, the EUR market is entering an ESG sweet spot as the momentum from favourable supply-demand dynamics that emerged in 2021-2022 have continued.

Key Takeaways:

- 'Greenium' remains alive and well in EUR: In 2023, EUR issuers continue to see the benefit of an ESG premium ('greenium') of approx. 5-10bps on average, with the benefit skewed towards use-of-proceeds format (green, social, sustainability bonds). In the secondary market, ESG Corporate bonds issued in February 2023 tightened an average of about 7bps from pricing compared to approximately 2bps across all EUR corporate deals.

- EUR investors return with ESG on their mind: As European fixed income ETFs saw record inflows in January, investors have cash to put to work with many eyeing ESG-labelled products to capture the outperformance in a rising interest rate environment.

- Source: Bloomberg; Corporate/Government bond new issuance volume (excluding loans) as of 3/1/2023.

- Source: Bloomberg; Corporate/Government new issuance volume across sustainable debt products (including loans) as of 3/1/2023.

TD Securities' ESG Solutions

TD Securities' ESG Solutions team is the centralized ESG expert resource, delivering financing advisory services, thematic and investor insights, and carbon markets solutions to help our clients reach their goals.

Director, ESG Solutions

Director, ESG Solutions

Director, ESG Solutions