Investing in AI Through Canadian ETFs

By: Andres Rincon

Jul. 05, 2023 - 3 minutes

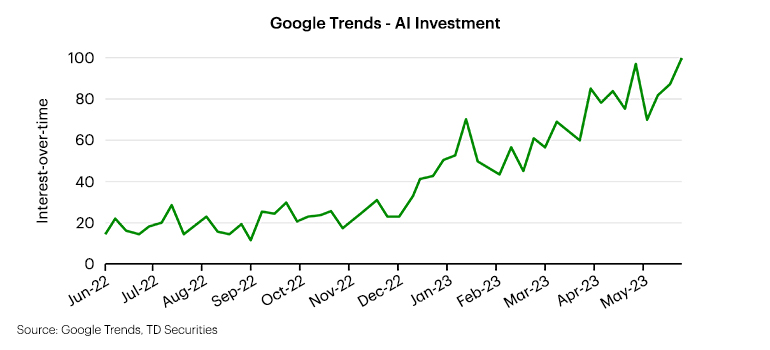

Investing in artificial intelligence (AI) has become a popular idea. Google Trends data shows that AI Investment searches have picked up substantially this year. This long growing trend accelerated with ChatGPT's launch, which catapulted the current AI frenzy. Since ChatGPT was released on November 30th, 2022, one of its major sponsors has posted a 32% rise in its stock price. A key hardware provider for the AI space has seen its stock price more than double year-over-year. The technology sector as a whole has also benefited from this trend with year-to-date growth of 42% in the S&P 500.

Although AI investment has become a big trend, and several U.S.-listed ETFs cater to this space, there are no actively traded ETFs currently listed in Canada focusing solely on AI. However, there are many thematic and broad ETFs in Canada that provide plenty of exposure to the AI space.

What does investing in AI mean?

The broad nature of AI benefactors makes it hard to pinpoint exactly what investing in AI means. It can mean investments in companies that produce the hardware necessary to build the machines running AI applications, or the company developing AI applications, or the company that invests in AI research, or the company that will benefit from developments in AI.

In the absence of a thorough fundamental analysis on each company claiming to be invested in AI, we find it best to leverage the work already done by the numerous U.S.-listed ETFs whose objective is to provide exposure to the AI space. These U.S.-listed AI ETFs all claim to provide exposure to the AI space, so a survey of the most common holdings and their weights should be a good indication of which companies would benefit from the growth of AI. By aggregating the holdings of these U.S.-listed ETFs and identifying the stocks most commonly held and with the highest weightings within these ETFs, a portfolio of the 40 most common stocks recognized as AI investments is created for our AI proxy basket.

Canadian ETFs with the Largest AI Exposure

Using the AI proxy basket of 40 stocks created from U.S.-listed AI ETFs, the Canadian ETF landscape is then screened for the ETFs with the greatest exposure to these stocks. The ETF screen naturally splits the ETF space into three categories, namely through thematic ETFs, covered call ETFs, and broad market index ETFs. Note that we discovered over 300 Canadian ETFs with some level of exposure to AI companies given that many of these companies are large cap and widely held by indices.

- Thematic ETFs provide the most concentrated exposure to AI companies. In fact, the ETF with the highest concentration to AI stocks is the Canadian version of a popular US AI theme ETF.

- Covered call ETFs have been particularly popular in today's environment, and many of these can also provide exposure to the AI space. Many investors view these ETFs as good hedge against high inflation.

- Broad Market Index ETFs are not specifically designed to track AI, but some broad ETFs heavily exposed to the technology sector still provide sizeable exposure to AI companies. Also, these ETFs often have a lower management fee than thematic and covered call ETFs and a more diversified portfolio.

Subscribing clients can access the full ETF Weekly report including the Canadian ETFs we found that contain significant AI exposure on the TD Securities Market Alpha Portal